A “100% correct” market indicator … what it’s saying about right now’s circumstances … the inspiration of Luke Lango’s buying and selling service … how the “macro” and “micro” are aligning right now

I’m searching for an indicator with a 100% hit fee.

I don’t need any uncertainty.

The 2022 bear market was too violent and too bloody for me to simply accept any room for error. I would like certainty, certainty, certainty, and slightly bit extra certainty – with a aspect of certainty, in the event that they’ll let me have it.

That comes from our hypergrowth skilled Luke Lango.

Now, I would like certainty too – all of us do. However the thought of “certainty” with regards to investing raises an eyebrow, at a minimal.

Effectively, Luke simply produced some fascinating analysis that calls for we a minimum of contemplate this concept. It’s an indicator that has a monitor document of 100% accuracy going again to 1950. And right now, it’s suggesting we’ve entered a brand new, sturdy bull market.

On this Digest, let’s dig into the analysis, take a look at what it means for upcoming market returns, then talk about the easiest way to place ourselves.

It’s all a precursor to a particular reside occasion that Luke is holding right now at 4 PM ET. There’s heaps to cowl, so let’s soar proper in.

Is that this the closest factor to “assured” in investing?

Buyers are at all times searching for an edge, some indicator or system that provides them a sneak preview about what’s coming.

There are numerous such indicators. Probably the greatest-known in technical circles is a Golden Cross.

That is when a shorter-term shifting common (MA) crosses over a longer-term shifting common. Essentially the most widely-referenced Golden Cross is when the 50-day MA pushes north by way of the 200-day MA.

Right here’s extra from Luke:

Normally, [a Golden Cross] is bullish.

The operative phrase there’s “often.”

Golden crosses are often bullish. They aren’t at all times bullish.

Since 1950, the S&P 500 has skilled 36 completely different golden crosses. About 80% of the time, shares are greater a 12 months later, with a mean return of about 10%.

These are good odds, however Luke takes it additional…

He analyzed historic knowledge to find out what occurred when a Golden Cross occurred at a value that was greater than 10% off all-time highs.

This has occurred 16 instances since 1950, and Luke discovered that in 15 of these cases (94%), shares the place greater a 12 months later with a mean return of 16%.

Clearly, these are improbable numbers, however not 100%.

And this leads us to Luke’s quest for certainty that opened right now’s Digest.

Whereas such a factor appears unimaginable, even laughable, the historic knowledge recommend in any other case

Luke narrowed down his Golden Cross inputs even additional.

He evaluated what occurred when the 50-day MA crossed the 200-day MA and remained above it for a minimum of three days. And this will need to have occurred after the 50-day MA has been under the 200-day MA for a minimum of 9 months prior (suggestive of an extended bear market).

Between 1950 and 2022, this “Tremendous Golden Cross,” as Luke calls it, has triggered solely eight instances.

Listed below are the outcomes:

…It’s infallible.

It isn’t 80% or 90% correct. Going again to 1950, it has a 100% accuracy of predicting bear market endings and bull market beginnings.

No false indicators. 100% accuracy. And common peak returns a 12 months later had been enormous, on the order of practically 25%!

Under are the returns. You may consider for your self.

Supply: InvestorPlace

As we famous earlier, Luke studies that we not too long ago triggered a Tremendous Golden Cross.

This alone is big information. We’ve an indicator with an ideal monitor document, suggesting a mean of 24% features are within the works for the broad market.

How can we enhance upon that?

That brings us to this afternoon’s occasion.

The inspiration of Luke’s buying and selling strategy to the markets

A precept referred to as “stage evaluation” is the inspiration of Luke’s strategy to buying and selling.

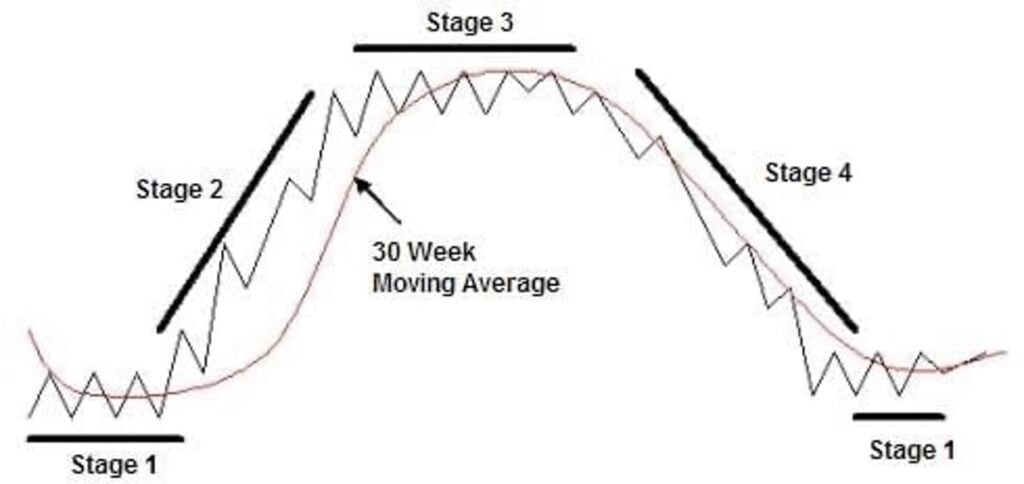

Briefly, a inventory is at all times in considered one of 4 distinctive levels: 1) going sideways at a backside, 2) going up, 3) going sideways at a high, or 4) happening.

Stage evaluation is the science behind determining which of those 4 levels a inventory is in at any given time limit.

The important thing to profiting by way of shorter-term buying and selling is by accurately figuring out Stage-2 breakouts and exiting as a Stage-3 sideways sample turns into Stage-4 declines.

So, that is precisely what Luke and his group did. They created a pc system programmed to seek out shares on the cusp of coming into a Stage 2 “escape.”

The mannequin scans the complete U.S. inventory market each single week, checks each inventory towards a set of parameters per a Stage-2 breakout, and returns the shares that match the profile.

Apparently, one of many parameters the mannequin searches for is a model of the Tremendous Golden Cross that we mentioned a second in the past.

One of many advantages of this buying and selling fashion is that it identifies shares which might be climbing no matter what the broad market is doing

Whereas a buy-and-hold investor would possibly watch his portfolio endure if the prevailing market sentiment is bearish, a stage-analysis-trader can zero in on particular breakout shares which might be climbing whereas the broader market languishes.

“There’s at all times a bull market someplace” is a phrase you’ve doubtless learn right here within the Digest after we make this level. Nevertheless, whereas that is true, whenever you commerce “towards the grain” of the broad market, you usually face a minimum of a partial headwind.

Take into account a hedge fund supervisor who sees stage evaluation commerce surging, regardless of a bear market. She would possibly wish to make investments, but when her different positions are down, she may not wish to lock in losses to unlock buying and selling capital. Or maybe she’s simply anxious due to the broader bearishness and prefers to take a seat on the security of money.

This creates a kind of alternative value whereby the returns of an against-the-grain commerce might not be maximized.

However when the broad market is bullish, that’s when stage evaluation buying and selling features can snowball as sentiment and macro/micro momentum align.

Tying this Digest collectively now, Luke’s analysis suggests the “macro” is now changing into bullish. The 100% correct Tremendous Golden Cross has offered that forecast.

In the meantime, Luke’s stage evaluation system is engineered to seek out the “micro” bullishness – in different phrases, the particular shares which might be surging, no matter what the broad market is doing.

However up to now, Luke’s system has needed to function in a broadly bearish market – the macro and micro have conflicted. Regardless of that, the system has carried out impressively.

What occurs now that the broad market seems to lastly be turning bullish?

Right here’s extra from Luke:

Already, even in a rocky surroundings, the system is crushing it – and we simply now entered a bull market.

I imply, final week, our system discovered a tiny inventory that none of our analysts had ever heard of – and now, it’s already up about 12%.

Final month, it discovered an AI inventory that popped 40% in a few week.

Earlier than that, it discovered a sources inventory that soared 45% in just some weeks and a biotech inventory that roared 100% greater in slightly over a month.

Level being: This technique works. And it repeatedly produced these sorts of features, even in a bear market.

Think about what will probably be able to throughout a fortune-making bear-to-bull transition…

This afternoon at 4 PM ET, Luke might be diving into all the small print of this. He’ll be speaking breakout triggers… bull market circumstances… stage evaluation commerce returns… learn how to discover enticing commerce candidates… and way more.

It’s a free occasion. Simply click on right here to order your seat.

Right here’s Luke with the ultimate phrase:

This afternoon, we’re unveiling our high quantitative buying and selling system. We use this technique to persistently discover the fastest-moving and highest-flying shares on Wall Road for fast features.

At right now’s occasion, we’re providing you with an unique likelihood to realize direct entry to this technique and its breakout inventory picks.

It may very well be your key to scoring enormous returns in 2023 – and past.

Have an excellent night,

Jeff Remsburg