Notice: InvestorPlace places of work might be closed for Independence Day on Monday, Jul. 3 and Tuesday, Jul. 4. Common hours, together with Buyer Service, will resume at 9:00 a.m. ET on Wednesday, Jul. 5.

Hi there, Reader.

The primary decade of the 2000s didn’t produce heat, fuzzy emotions for many inventory buyers. However that decade delivered infinite delights for commodity-focused buyers. A repeat efficiency could also be underway.

However earlier than wanting forward, let’s take a fast look again on the previous…

From early 1999 to mid-2008, the TR/CC CRB Index of commodity costs quadrupled, whereas the S&P 500 produced a return of roughly zero. That strong, market-trouncing commodity growth sprung from what had been a decade-long commodity bust.

Such is life within the commodity sector: Nice, huge busts, which result in nice, huge booms…after which again to busts once more. Skilled buyers confer with this phenomenon as a “commodity supercycle.”

They’re the monetary market equivalents of a New Yr’s Eve get together – a protracted, giddy night of extra…adopted by a protracted, depressing hangover. As buyers on this sector, the trick is to seize as a lot of the get together as doable, whereas avoiding as a lot of the hangover as doable.

Don’t Make This Large AI Investing Mistake…

On daily basis that you just sit on the sidelines for this AI revolution might imply you’re LOSING your likelihood at early earnings. Don’t make that mistake – watch the playback of the AI Tremendous Summit whilst you nonetheless can – click on right here.

The Commodity Supercycle

Right here at Sensible Cash, I’ve acknowledged a number of occasions that the commodity markets are within the early innings of a robust, new supercycle, which erupted from the Covid-panic lows of April 2020.

Measured from that low, the CRB Index has gained about 150% – or about half the 300% achieve the CRB achieved over the past supercycle. At a minimal, due to this fact, commodity costs ought to double from present ranges earlier than this new get together ends.

However I’m anticipating this specific supercycle to supply a extra spectacular outcome than that, because of surging demand for “battery metals” from the electrical automobile (EV) and renewable power industries.

For instance, business insider Robert Friedland believes the copper market is heading for a supply-crunch “practice wreck” that would trigger the metallic’s value to soar 10-fold from present ranges.

He warns that the worldwide copper provide will wrestle to maintain tempo with surging demand. A provide crunch will outcome, he says, on account of the truth that main new deposits have gotten trickier to search out and pricier to unearth.

But, regardless of this looming risk to the copper market, and to different key metals markets like nickel and lithium, commodity costs have been dozing within the nook for greater than a yr.

This seeming narcolepsy is main many buyers to imagine the commodity supercycle is over already. In addition to, why trouble with “old-fashioned” investments like mining corporations, when synthetic intelligence (AI) investments are all the fad?

The Commodity Rally Isn’t Lifeless

The reply is an easy one: The commodity rally isn’t lifeless; it’s merely pausing earlier than beginning its subsequent main transfer increased. Let’s not overlook two vital elements.

First, the Russian invasion of Ukraine created an “synthetic” spike in commodity costs that has been step by step unwinding throughout the previous few months. Second, the Federal Reserve has been elevating rates of interest for the final 15 months, which is a development that often pressures commodity costs.

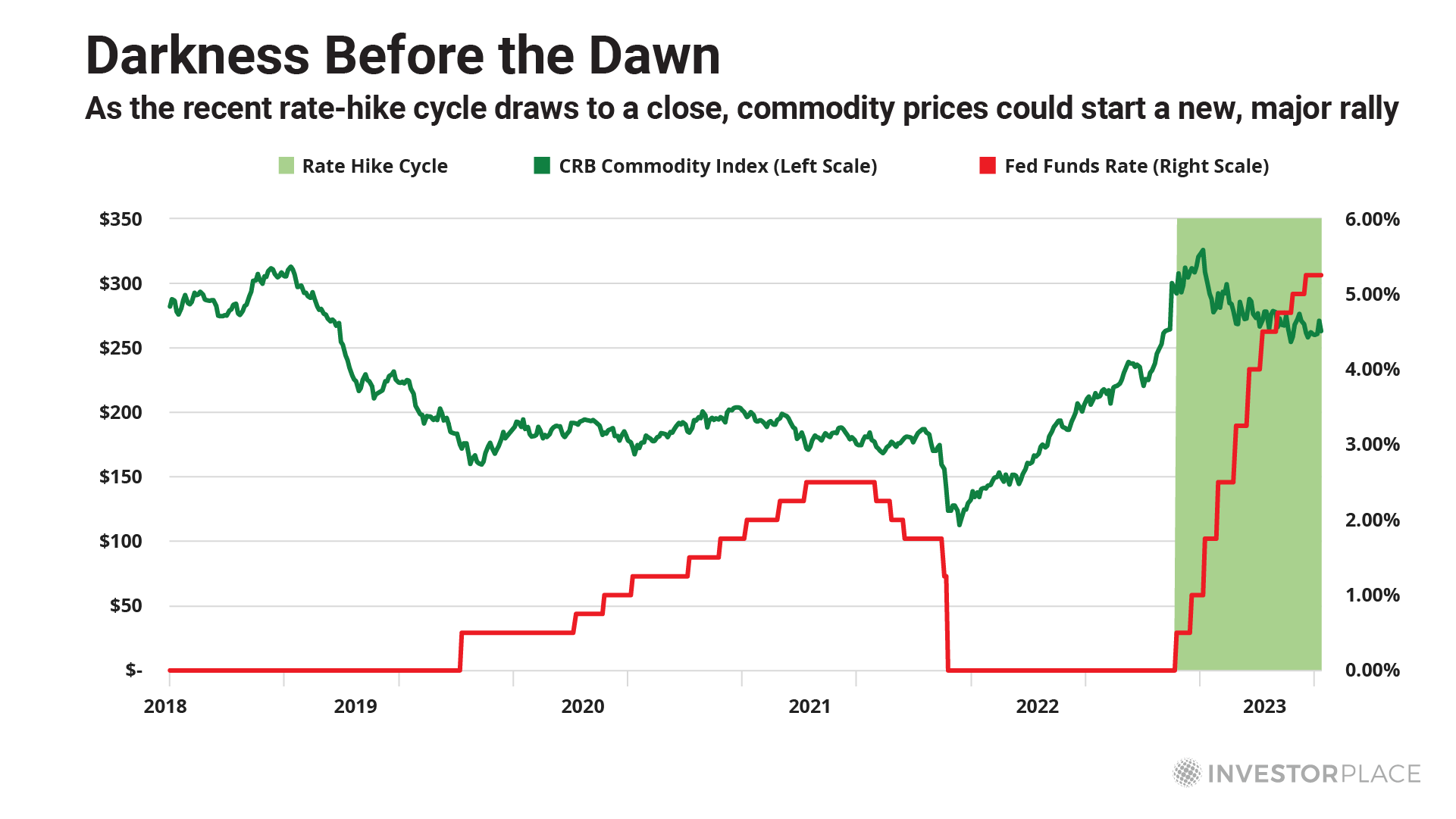

Because the chart beneath reveals, nearly instantly after the Fed initiated its present rate-hike cycle (space shaded in inexperienced), commodity costs began drifting decrease.

That’s the unhealthy information for commodity buyers. The excellent news is that the Fed is near ending its rate-hike cycle, and it could shift to decreasing charges someday subsequent yr.

If the previous is prologue, that shift could possibly be a giant boon to commodity costs. For proof of this tendency, take an in depth have a look at the interval on the chart from March 2020 to March 2022. That’s when the Fed slashed rates of interest from 2% to zero. Commodity costs soared nearly instantly.

To make sure, synthetic intelligence is the subject that’s sparking the best buzz within the inventory market, and for good motive. This new-new factor is making a bounty of wealth-building alternatives.

However that doesn’t imply old-old issues just like the commodity markets will merely fold up their tents and go house. Many shares in that sector might ship AI-like performances over the following couple of years, because the commodity supercycle enters its subsequent main explosive section. So, don’t rely commodity investments out simply but.

Regards,

Eric Fry

Eric Fry

Editor, Sensible Cash