Congress launched a extremely anticipated report on Wednesday detailing how main tax prep firms and massive tech corporations like Google and Meta, mum or dad of Fb and Instagram, “recklessly” shared the delicate tax information of tens of thousands and thousands of Individuals with out correct safeguards. The senators cited proof from their report in a fiery letter to the IRS, FTC, DOJ, and Treasury Inspector Common, whom they urged to completely examine the matter and to prosecute firms discovered to have violated tax legal guidelines.

“The findings of this report reveal a stunning breach of taxpayer privateness by tax prep firms and by Large Tech corporations that appeared to violate taxpayers’ rights and should have violated taxpayer privateness regulation,” Sens. Bernie Sanders, Elizabeth Warren, Richard Richard Blumenthal, Ron Wyden, Tammy Duckworth, Sheldon Whitehouse, and Rep. Katie Porter mentioned within the letter.

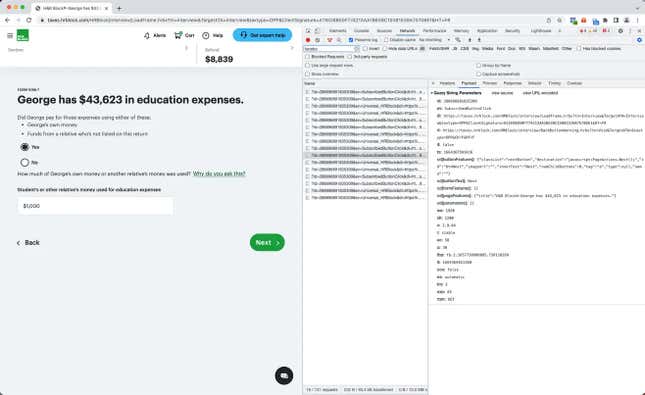

The brand new 54-page report builds off of a November investigation by The Verge and The Markup which detailed the methods H&R Block, TaxAct, and TaxSlayer used a service referred to as Meta Pixel to share taxpayer information with Fb and Instagram. That information was then used to serve focused adverts and feed Meta’s algorithms. TaxAct additionally reportedly despatched related information to Google via its analytics instrument, although names weren’t included.

The brand new report says the businesses used pixels, a type of monitoring know-how, to scan tax paperwork and reveal a variety of figuring out info together with taxpayers’ full names, submitting standing, federal taxes owed, names of dependents, addresses, and date of beginning, amongst different information factors. The lawmakers declare the corporate’s information sharing occurred for years with out correct disclosure of applicable taxpayer consent. All of that amounted to the businesses vacuuming up information on probably tens of thousands and thousands of filers. The gathering of dependents’ names means tax filers’ kids had been doubtless included within the huge information assortment.

As soon as shared with Meta and Google, taxpayer information was then used to grease Large Tech’s on-line enterprise behemoth, the report notes. The lawmakers mentioned Meta confirmed it used the information collected for focused promoting and to coach its personal AI algorithms.

TaxSlayer didn’t instantly reply to requests for remark. H&R Block informed Gizmodo it takes defending its consumer’s privateness “very significantly” and has “taken steps to forestall the sharing of knowledge through pixels.” A spokesperson for TaxAct mentioned the corporate has been involved with Sen. Warren and has “at all times complied with legal guidelines that defend our clients’ privateness.”

“As famous within the report, we disabled the instruments in query whereas we evaluated potential issues,” the TaxAct spokesperson added .

Tax prep firms shared pixels for years

Many web sites you in all probability work together with each day doubtless use pixels, however the lawmakers mentioned tax prep firms ought to have taken far better care to make sure they didn’t use the trackers to entry extremely delicate tax info. All three of the tax prep firms named within the report admitted to utilizing Meta Pixel for “at the very least a few years.” They reportedly used Google Analytics even longer. The prep firms and tech firms all mentioned the information shared was nameless, however lawmakers say consultants on the FTC and elsewhere declare that information could possibly be simply used to establish folks when within the flawed palms.

In a press release, a Meta spokesperson informed Gizmodo it has insurance policies prohibiting advertisers from sending delicate details about folks via its enterprise instruments.

“Doing so is towards our insurance policies and we educate advertisers on correctly organising Enterprise instruments to forestall this from occurring,” the spokesperson mentioned. “Our system is designed to filter out probably delicate information it is ready to detect.”

Google, in the meantime, informed us it has “strict insurance policies and technical options” that prohibit Google Analytics customers from gathering information that could possibly be used to personally establish somebody.

“Website homeowners—not Google—are in charge of what info they gather and should inform their customers of how it will likely be used,” a Google spokesperson mentioned. “Moreover, Google has strict insurance policies towards promoting to folks based mostly on delicate info.”

“Large Tax Prep has recklessly shared tens of thousands and thousands of taxpayers’ delicate private and monetary information with Meta for years, with out appropriately disclosing this information utilization or defending the information, and with out applicable taxpayer consent,” the lawmakers wrote of their report.

The lawmakers claimed filters Meta and Google reportedly used to establish information unintentionally collected had been “ineffective.”

The lawmakers consider the tax prep firms could have violated a number of US taxpayer privateness legal guidelines by sharing delicate info with out first acquiring written consent. The FTC and IRS didn’t instantly reply to Gizmodo’s requests for remark.

Replace, 12:58 p.m. EST: Added assertion from Google.

Replace 5:15 p.m. EST: Added assertion from TaxAct.