As we’ve talked about in latest weeks, the Fed just lately conveyed some unbelievable information: It’s close to the top of its present charge mountaineering cycle.

On the March Federal Open Market Committee (FOMC) assembly, the Fed hiked charges by 25 foundation factors and supplied a dovish assertion – excluding the earlier phrase of “ongoing” charge will increase and added “some further” coverage firming by be wanted.

However the Fed’s job isn’t completed simply but. Now it must un-invert the yield curve.

An inverted yield curve is when the two-year Treasury yield is above the 10-year Treasury yield. The yield curve first inverted on April 1, 2022. It briefly reverted again to a standard curve, however reinverted once more in July.

The excellent news is the curve is loads much less inverted right now than it was not that way back. In early March 2023, the two-year Treasury yield was at %, whereas the 10-year Treasury yield was at 3.968%. As of this writing, the two-year Treasury bond is at 3.77% and the 10-year Treasury bond is at 3.29%.

There are two steps the Fed must take to un-invert the yield curve. Step one is to cease elevating key rates of interest, which it signaled on the March FOMC assembly.

The second step has to do with its open market operations. As I just lately acknowledged on CNBC:

[The Fed] ought to begin with their open market operations and get the short-term a part of the curve down… Once they say they’re going to do some open market motion, proper now they’re draining liquidity. They don’t let you know the place within the curve they’re doing to be doing that … Of their open market motion, they need to shift it to the quick a part of the curve. And so they need to attempt to push the yield curve down.

The truth is it is vitally necessary that the yield curve is un-inverted, and in right now’s Market 360, I’ll clarify why. However first, let’s talk about what precisely a Treasury yield is…

What Is a Treasury Yield?

Treasury yields are principally the curiosity you earn whenever you personal U.S. Treasury payments, notes, bonds or inflation-protected securities. The U.S. Division of Treasury sells these securities as a method to pay for the U.S. debt.

The very first thing to learn about bond yields is that they transfer inversely to bond costs, similar to a dividend inventory. If the worth of the bond goes down, you’re incomes a better charge of return since you paid much less. The other is true when bond costs go up. So, everytime you see the yield rise, the worth of the bond is falling.

The second factor to know is that Treasury costs fluctuate with provide and demand. Treasury bonds are offered at public sale initially, however they may also be purchased and offered within the secondary market after they’re issued. If there’s numerous demand, the bond will promote for a worth above face worth, which then lowers the yield. On the opposite aspect, if there’s much less demand, then the worth of the bond will probably be decrease and the yield will rise. At maturity, the federal government pays again the face worth of the safety with curiosity.

As a result of Treasury payments are backed by the U.S. authorities, folks view them as very safe. That’s why demand for Treasury bonds goes up (and consequently forces yields down) in occasions of financial uncertainty.

Securities with a long-time horizon typically have the very best rates of interest. Traders demand a better return if they’ve to attend longer till maturity. This will get us to what’s known as the “yield curve,” which you might have in all probability heard loads about this yr as a result of it is among the most-watched indicators in the case of signaling recessions.

What Is an Inverted Yield Curve?

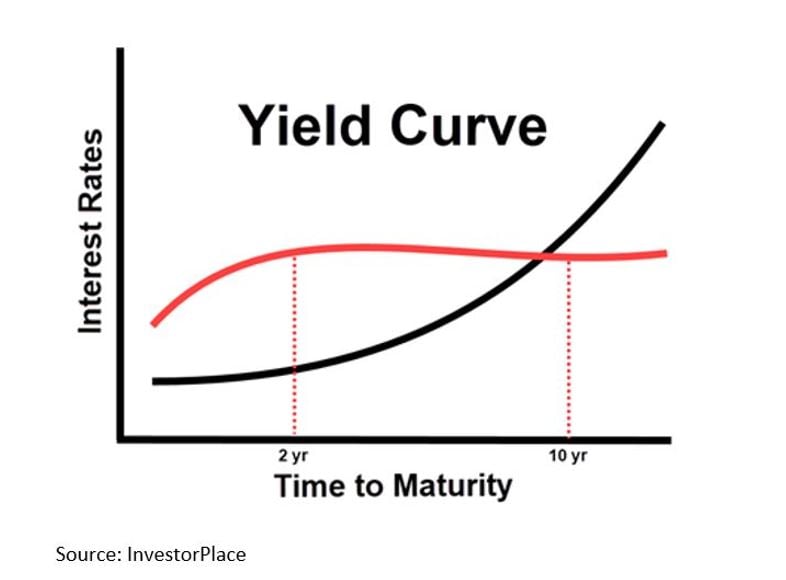

The yield curve refers back to the relationship between short-term yields and long-term curiosity yields. Lengthy-term bonds pay a better yield than short-term bonds in a standard market. You may see a standard yield curve within the chart under, created by my InvestorPlace colleagues John Jagerson and Wade Hansen for his or her Strategic Dealer readers. The black line is the long-term yield (10 yr), and the pink line exhibits the short-term yield (two yr).

The yield curve “flattens” when long-term and short-term charges are about the identical. Nevertheless, it “inverts” when short-term yields rise above long-term yields. As I discussed earlier than, the two-year Treasury bond is at the moment greater than the 10-year Treasury bond – so the curve stays inverted right now.

So, what are the yields telling us now?

An Inverted Treasury Yield Curve Is Unhealthy Information for the Financial system

An inverted yield curve has served as a precursor for a recession previously. In reality, since 1956, each recession was preceded by an inverted yield curve. The oldsters at Bespoke famous that when the two-year and 10-year Treasury yield curve invert there’s a greater than 67% chance that the U.S. will fall into recession in 12 months and a greater than 98% chance {that a} recession will happen within the subsequent two years.

In keeping with Bloomberg, the final persistent inversion of the Treasury yield curve occurred in 2006-2007 forward of the 2008 recession.

So long as the yield curve stays inverted, we’re going to proceed to have banking points. And if there’s any failure within the banking system, it hurts all banks. This, then, hurts commerce, innovation, and one thing known as the “velocity of cash,” which is the measured charge at which cash is exchanged in an economic system.

The underside line: An inverted Treasury yield curve has a substantial impact on the markets and the general economic system. For this reason it’s crucial the Fed does the fitting factor and finishes un-inverting the yield curve.

Now, as buyers, the query turns into: How will we revenue in an unsure financial atmosphere?

The secret’s figuring out the place to place your cash.

Basically, we’re basically getting into a funnel the place cash is diverted to shares with the strongest forecasted earnings progress – and fewer shares will lead the general market greater.

On this atmosphere, it stays crucial that we management our personal future by investing in essentially superior shares which might be impervious to financial cycles.

It’s for that reason that I stay laser-focused on essentially superior shares, as these are those that ought to get away as new market leaders within the coming months. In reality, in final Friday’s Progress Investor Month-to-month Concern for April, I beneficial 5 new essentially superior shares. All 5 are uniquely positioned to prosper of their respective corners of the market and are backed by superior earnings and gross sales progress.

For those who’d just like the names of my newest suggestions, merely click on right here to turn out to be a member of Progress Investor right now. When you do, you’ll have full entry to my newest Month-to-month Points, Weekly Updates, Particular Market Podcasts and rather more!

Click on right here to study extra and be part of me at Progress Investor right now.

Sincerely,

Supply: InvestorPlace until in any other case famous

Louis Navellier