Given yesterday’s report that Goldman Sachs is seeking to bail on its partnership with Apple, I assumed it will be fascinating to do a breakdown of the increasingly-messy relationship between the 2 firms. After forging their partnership in 2019, Apple seems to have thrived whereas Goldman Sachs has suffered.

The origins of Apple Card and Goldman Sachs

Information of Apple’s partnership with Goldman Sachs first emerged in February 2019 from the Wall Road Journal. That’s the identical information outlet that’s now reporting on Goldman’s effort to again out of the deal and move it off to American Specific.

Apple introduced Apple Card throughout its services-focused particular occasion one month later at Steve Jobs Theater. The corporate additionally unveiled Apple TV+, Apple Arcade, Apple Information+, and extra throughout this occasion.

Apple Card launched to most people in August 2019, permitting customers to use for the cardboard and test their credit score traces and approval standing and not using a exhausting credit score test.

A report just a few months later revealed some early particulars on Goldman’s funding in Apple Card. By all indications, it was a profitable launch, with Tim Prepare dinner touting throughout an October 2019 earnings name that it was the “most profitable launch of a bank card in the US ever.”

Throughout that very same earnings name, Tim Prepare dinner introduced that Apple Card customers would have the ability to finance iPhone purchases over 24 months with 0% curiosity. Because the backing financial institution behind Apple Card, Goldman Sachs was on the hook for funding these loans. The brand new financing possibility launched to the general public in December.

Allegations of Apple Card gender bias

In November 2019, nevertheless, there was a flareup of controversy surrounding Apple Card after allegations of gender bias emerged. Primarily, Apple Card customers had observed that gender discrimination was affecting the algorithms used to find out credit score limits for Apple Card.

Throughout this controversy, which led to a number of regulatory investigations, Apple stayed fully silent. Goldman Sachs issued a number of statements on the matter, explaining that the financial institution was “dedicated to making sure our credit score choice course of is truthful.”

The financial institution shouldered the entire burdens of the controversy, which isn’t shocking on condition that Goldman Sachs is the one who makes approval choices for Apple Card. Nonetheless, I’m positive Goldman Sachs would have appreciated slightly extra public-facing assist from Apple.

Apple Card financing and COVID-19

Transferring forward to 2020, Apple and Goldman Sachs expanded the 0% financing supply to the remainder of Apple’s product lineup in June, together with Mac, iPad, AirPods Professional, AirPods, Apple Pencil, and extra.

All through 2020 amid the COVID-19 pandemic, Goldman Sachs allowed Apple Card customers to defer their funds with out curiosity. This was billed because the “Buyer Help Program” and repeatedly prolonged by means of late 2020.

Different modifications to Apple Card in 2020 included:

Apple Card Household

In 2021, Apple Card acquired a significant enhance with the launch of Apple Card Household. This addressed one of many long-time limitations of the platform and at last enabled customers to share the identical Apple Card with different relations by way of iCloud Household Sharing.

Additionally in 2021, Apple touted the continued success of Apple Card, citing a JD Energy Research that discovered the cardboard to rank “among the many Midsize Credit score Card phase and obtained a chart-topping rating of 864.”

Different Apple Card and Goldman Sachs tales from 2021:

Indicators of battle for Goldman Sachs emerge

Whereas Apple Card continued to develop in reputation, with over 6 million estimated cardholders, some early indicators of battle started to emerge.

In Could 2022, Scott Younger, a Goldman Sachs government credited for his work securing the Apple Card deal, left the financial institution. Younger was Goldman’s head of partnerships in 2018, which is when Goldman and Apple reached an settlement to work collectively on Apple Card.

Subsequent, Goldman Sachs introduced that it was dealing with a probe from the Client Monetary Safety Bureau over its client bank card enterprise. The Apple Card’s “speedy progress” and Goldman’s battle managing and scaling that progress had been guilty for the investigation.

One of many main focuses of that investigation was Goldman’s dealing with of Apple Card disputes. A dispute, or chargeback, is when a buyer information a chargeback on a transaction, both as a result of it was unauthorized or as a result of the products or providers weren’t because the service provider described.

Goldman obtained “extra disputes than it counted on” from Apple Card prospects, and it struggled to handle that progress – particularly given the entire regulatory necessities that encompass bank card disputes. The drawback was so dangerous that Apple and Goldman Sachs even gave prospects a second likelihood at disputing transactions after complaints.

In October 2019, Regardless of the indicators of battle rising, Goldman Sachs CEO David Solomon stated that the corporate had reached a take care of Apple to increase the partnership by means of 2029.

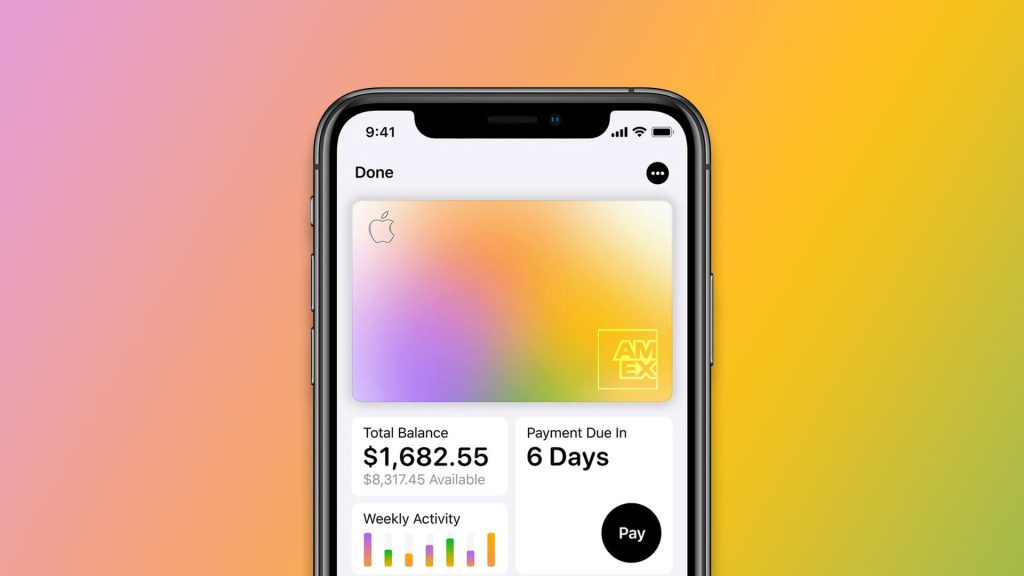

Then, in January 2022, Goldman Sachs revealed that it had misplaced over $1 billion on its Apple Card partnership since 2020. Whereas not a direct “loss” but, laws require Goldman to put aside a sure about to cowl itself towards potential nonpayments. The following month, Goldman claimed it was nonetheless “dedicated” to the partnership with Apple regardless of these losses. “It’s a really, very sturdy partnership the place there’s a number of alternative,” Solomon stated.

Solomon did acknowledge, nevertheless, that Goldman “in all probability took on greater than we should always have, an excessive amount of, too shortly” with reference to its push into client banking.

In April, Goldman Sachs expanded its relationship with Apple with the launch of the Apple Card Financial savings Account. Goldman Sachs can also be the issuer of the Mastercard cost credential used to finish Apple Pay Later purchases.

9to5Mac’s Take

That brings us to the place we’re right now. The Wall Road Journal studies that Goldman Sachs desires to finish its partnership with Apple and is “in talks with American Specific to take over its Apple bank card and different ventures.” Apple is alleged to pay attention to these negotiations and would wish to log out on a deal earlier than something might be finalized.

The larger image right here can also be vital to remember. Goldman Sachs had deliberate to make use of Apple Card to bolster its efforts to increase into client banking. The financial institution’s solely different client bank card is a co-branded card with Basic Motors, which it’s also seeking to offload doubtlessly to American Specific. The financial institution was in negotiations to launch a co-branded bank card with T-Cell however backed out of these talks.

Goldman has additionally scaled again Marcus, which which is its broader client banking enterprise. This consists of private mortgage originations.

Forward of the general public Apple Card launch in 2019, Goldman’s head of client digital finance, Omer Ismail, stated the corporate wasn’t apprehensive about Apple Card’s profitability. “After I take into consideration Marcus total, the concept that doing proper by the shopper means being much less worthwhile is simply not an thought we subscribe to,” Ismail stated. “For those who do proper by the shopper, you’re going to in the end win their loyalty.”

And at last, amid all of this, Apple can also be ramping up its in-house private finance efforts as a part of its efforts to cut back reliance on third events like Goldman Sachs. Internally, that is known as “Challenge Breakout” and would convey issues like lending, fraud evaluation, and credit score checks in-house.

I’ve gotten a number of questions on what it’d imply for purchasers if Apple Card is transferred to American Specific. Because it stands right now, there are not any particulars on that. Notably, this deal would additionally imply that Apple Card would not be a Mastercard.

The advantages that Apple will get for Apple Card is evident. It attracts extra customers to the Pockets app. It encourages the usage of Apple Pay. The financing offers a simple manner for purchasers to purchase Apple merchandise they wouldn’t purchase in any other case.

One factor to remember is that the majority Apple Card customers probably don’t even know Apple Card is backed by Goldman Sachs. Goldman Sachs exists within the backend, and every thing else is managed immediately by means of the Apple Pockets app. There’s a Goldman Sachs brand on the again of Apple Card, however Apple naturally doesn’t present this in any of its advertising and marketing supplies.

I see two outcomes:

- Apple works with Goldman Sachs and makes modifications to Apple Card to make it a sustainable enterprise for Goldman Sachs.

- Apple lets Goldman Sachs out of the settlement (in all probability will make them pay a gazillion {dollars} in penalties/breakup charges). It then inks a brand new take care of somebody like Amex and types the change as “Apple Card 2” or related.

So to recap:

- Goldman desires out of a deal that it’s shedding massive cash on…

- and the place it will get little publicity or model consciousness…

- and its companion is actively working behind the scenes to desert it in favor of an in-house resolution…

- whereas it continues to fund the present model of the product at a loss and shoulder a number of the damaging PR burden…

I discover this complete scenario fascinating, and I’ve a bunch of inquiries to I’ll in all probability by no means study the solutions. Did Apple take Goldman for a experience? Reap the benefits of a financial institution with out a lot expertise in client banking?

FTC: We use earnings incomes auto affiliate hyperlinks. Extra.