Given the restricted manufacturing numbers anticipated for the Imaginative and prescient Professional, “will probably be flying off the cabinets, preordered by Apple’s loyal followers and excessive net-worth customers within the US,” in line with a new report from Canalys.

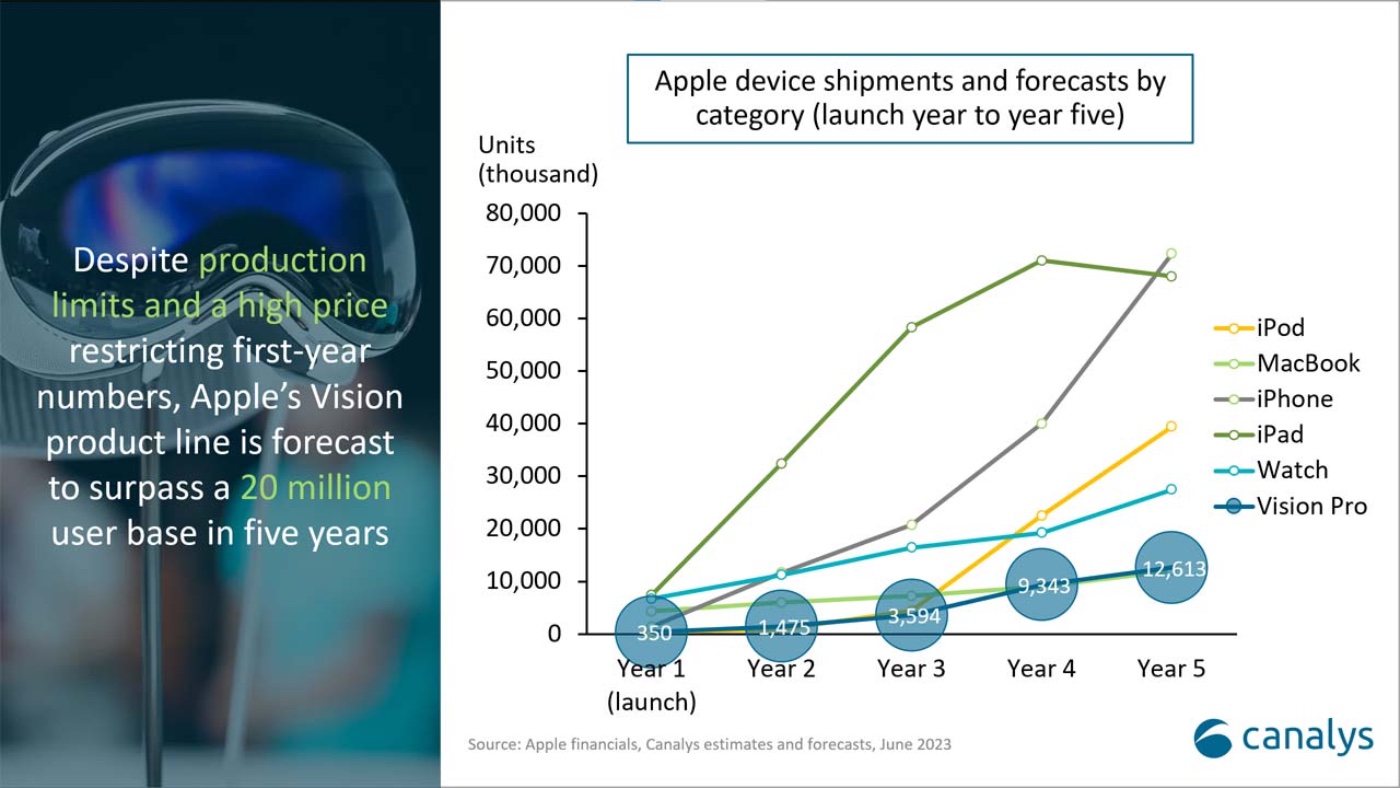

“The success of the primary era will give Apple and its provide chain valuable suggestions on product enhancements. In the meantime, business gamers will speed up funding, and cost-efficient options will emerge to extend Apple’s margin on the machine,” Jason Low and Nicole Peng write for the analysis group. “In years two and three, the second Imaginative and prescient Professional will seemingly hit the market, attaining excessive development from a low base. With a gentle build up of the person base to a brand new computing platform and distribution channel, it can surpass 10 million annual shipments in years 4 and 5, which is round 1% of the iPhone’s present put in base.”

The US$3,499 (and up) Apple Imaginative and prescient Professional was unveiled at this month’s Worldwide Developer Convention. Nonetheless, it gained’t go on sale till early 2024.

Different notes from the Canalys report:

° By calling the Imaginative and prescient Professional a spatial computing machine, Apple positions the headset as the following computing platform reasonably than simply an adjunct associated to the cell or PC ecosystem.

° The Imaginative and prescient Professional continues to be a consumer-first machine, regardless of its excessive value and the impression that it’s primarily aimed toward creators and companies.

° The Imaginative and prescient Professional being a client consumption and productiveness machine means Apple should depend on its present ecosystem to generate use instances distinctive to it. With content material high quality and person expertise upgrades to match the capabilities of the Imaginative and prescient Professional, Apple’s content material and companies enterprise flywheel is predicted to develop stronger, making it difficult for rivals, particularly these counting on third events for content material and companies, to copy what it’s doing.