Editor’s notice: “A Golden Ticket to Profiting From ‘Hidden’ Bull Markets” was beforehand revealed in January 2023. It has since been up to date to incorporate essentially the most related data out there.

What if I advised you that one tiny sector of the inventory market was usually accountable for greater than 30% of the market’s largest winners?

Not excellent now however on daily basis, week, month, yr.

You’d take a look at me skeptically. Possibly you’d name me loopy. However, nonetheless, it’s true.

I’m this yr’s leaderboard proper now; 5 of the highest 10 best-performing shares are from this tiny sector.

Over the previous yr, this sector accounts for six of the highest 10 best-performing shares.

In 2021, it accounted for 4 of the highest 10 shares.

In 2020, 5 of the highest 10 shares had been from this sector.

And in 2019, three of the highest 10 shares had been from this sector.

Fairly wonderful, proper?

One tiny sector of the market – which, by my calculation, collectively accounts for lower than 1% of the market’s whole worth – usually accounts for greater than 30% of the market’s best-performing shares.

These are essentially the most explosive shares available in the market.

However they’ve one deadly flaw: They’re exceptionally dangerous.

Thus far in 2023, this sector accounts for 5 of the highest 10 best-performing shares. It additionally accounts for 4 of the ten worst-performing shares.

This sector is the quintessence of high-risk, high-reward.

That’s in all probability why you and 99% of buyers keep away from this sector altogether. It’s too dangerous.

However what if there’s a method to put money into the sector whereas mitigating threat? What if there was a method to faucet into this sector’s usually large revenue potential whereas decreasing draw back publicity?

Theoretically, that will be one of the best buying and selling technique on the planet.

Properly, it’s a buying and selling technique we simply developed.

Right here’s a deeper look.

A Bull Market Is All the time Roaring

It doesn’t matter what’s happening with the broad market indices or what number of crises could be popping up across the globe, there’s at all times a sector, an asset class, or a bunch of shares that’s surging – and making its buyers fistfuls of cash.

Why? As a result of we dwell in an $80 trillion world financial system.

That’s some huge cash. In truth, it’s a lot cash that it’s assured not all of it should at all times transfer in the identical course.

Let’s pull out the sports activities analogies.

Even the worst free-throw shooter on this planet will hit at the very least a couple of throws if you happen to give them 80 trillion photographs. Even the worst batter will hit the ball a couple of instances if you happen to pitch to them 80 trillion instances.

By the identical token, even a couple of shares will rise within the worst of macroeconomic situations if you happen to give these shares $80 trillion to work with.

In our world financial system, one thing is at all times going up, and one thing is at all times taking place. Each are at all times true.

So, as a substitute of specializing in what “the market” is doing, I like to recommend this. Remember that it’s not a lot a inventory market as it’s a market of shares.

And because of these shares’ wildly differing fates, there’s at all times a bull market printing cash for buyers who know the place to look.

Enormous Alternative in Hidden Bull Markets

Let’s take this a step additional to ensure we’re on the identical web page.

After I write “bull market,” I don’t imply positive factors of 25%, 30%, and even 50%.

Now, I’m not scoffing at these returns. Who doesn’t wish to make 50% on an funding?

However what I’m speaking about is 100%-plus returns in a single yr. And once more, that is no matter what’s taking place within the S&P 500 or the Nasdaq, the commodities market, or elsewhere.

Let’s put some actual numbers on this as a way to see for your self.

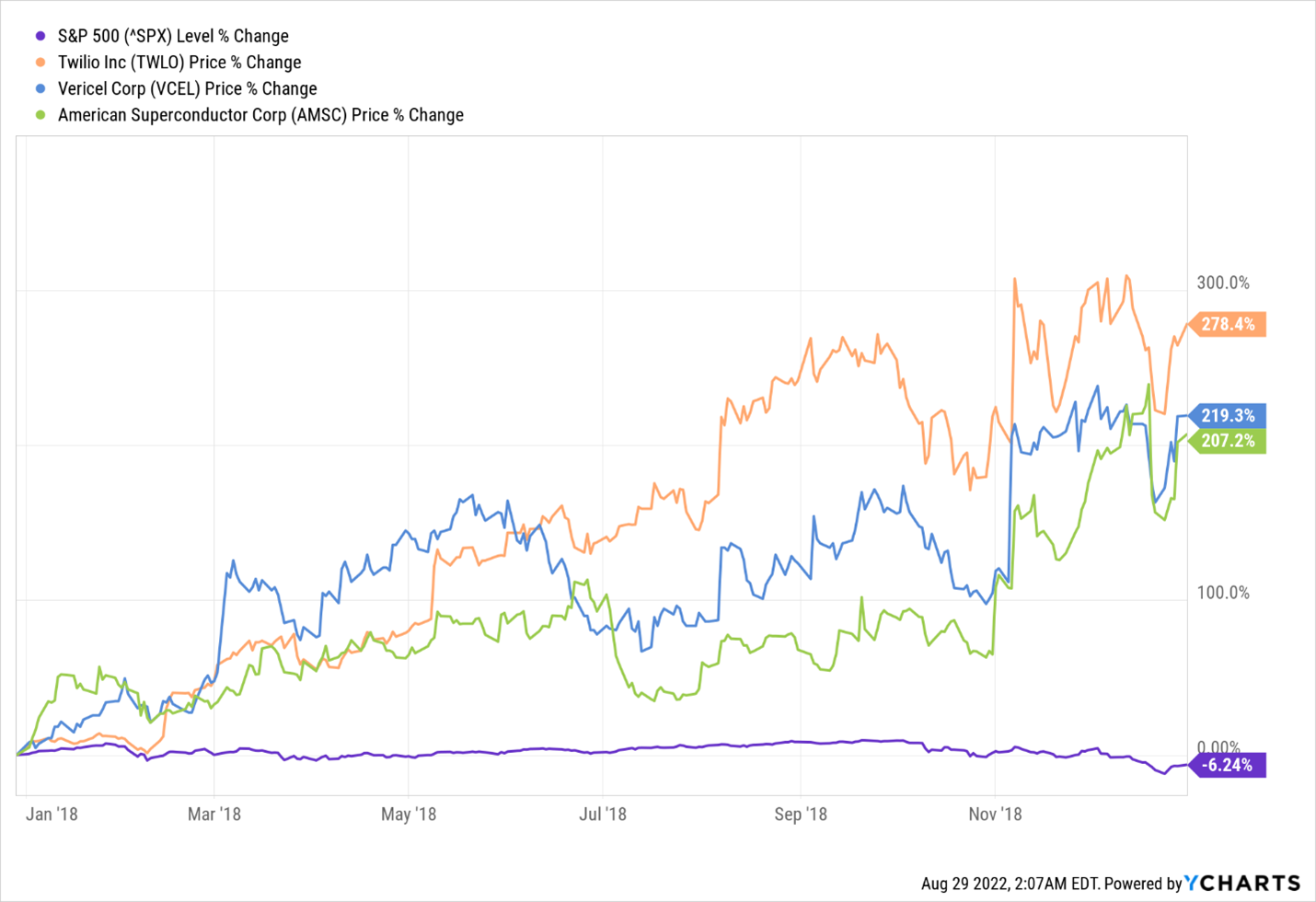

In 2018, the S&P fell by 6.24% for the whole yr.

In the meantime, over that very same 12-month interval, Brilliant Mountain Media (BMTM) soared 360%. Twilio (TWLO) climbed 278%. Vericel (VCEL) rose 219%, and American Superconductor (AMSC) jumped 207%.

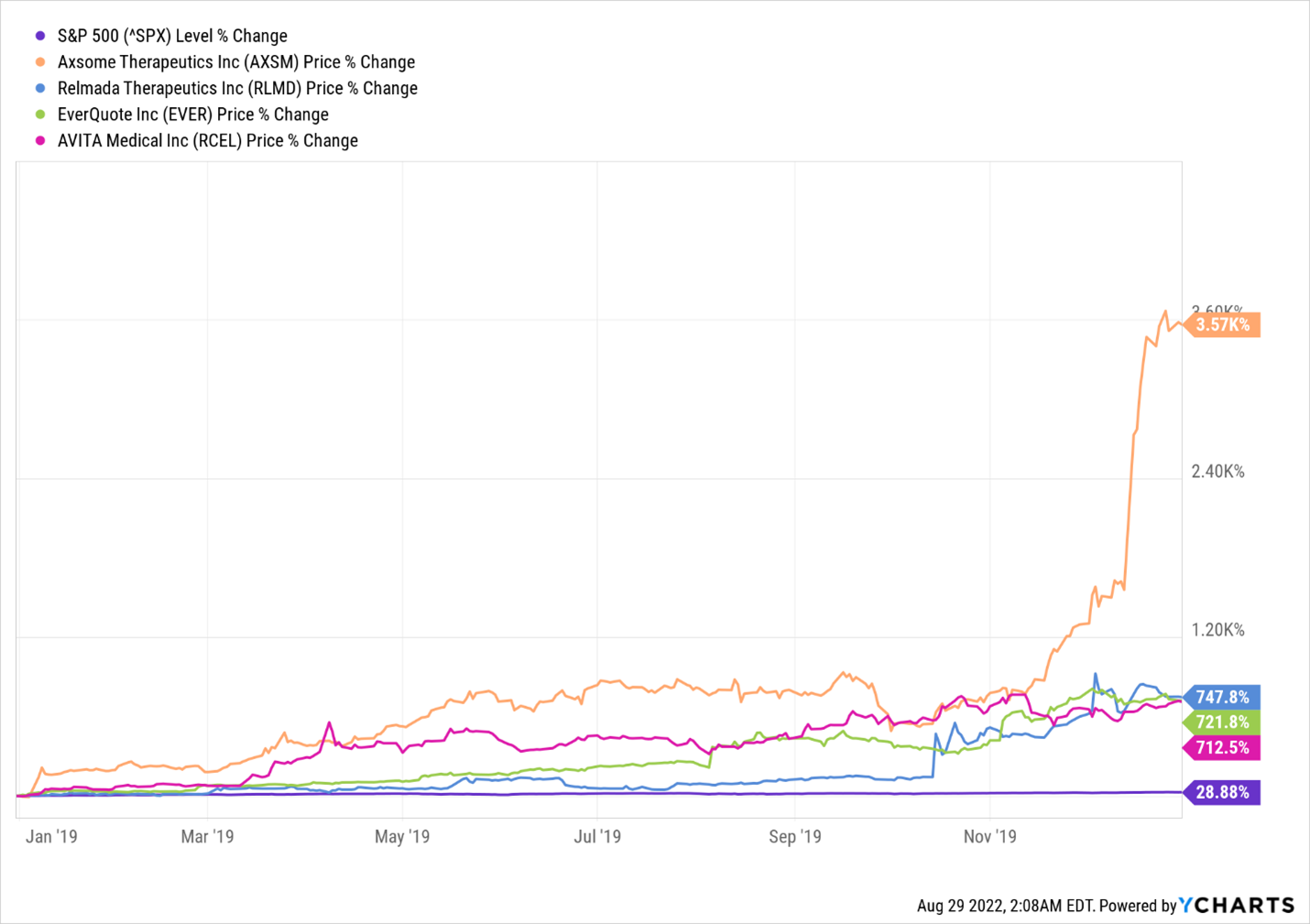

In 2019, the S&P had an ideal yr, up 29%.

However that bull market was nothing in comparison with what occurred for Axsome Therapeutics (AXSM), which erupted 3,565% over those self same 12 months, Relmada Therapeutics (RLMD), up 748%. To not point out EverQuote (EVER), which climbed 722%, or AVITA Medical (RCEL), up 713%.

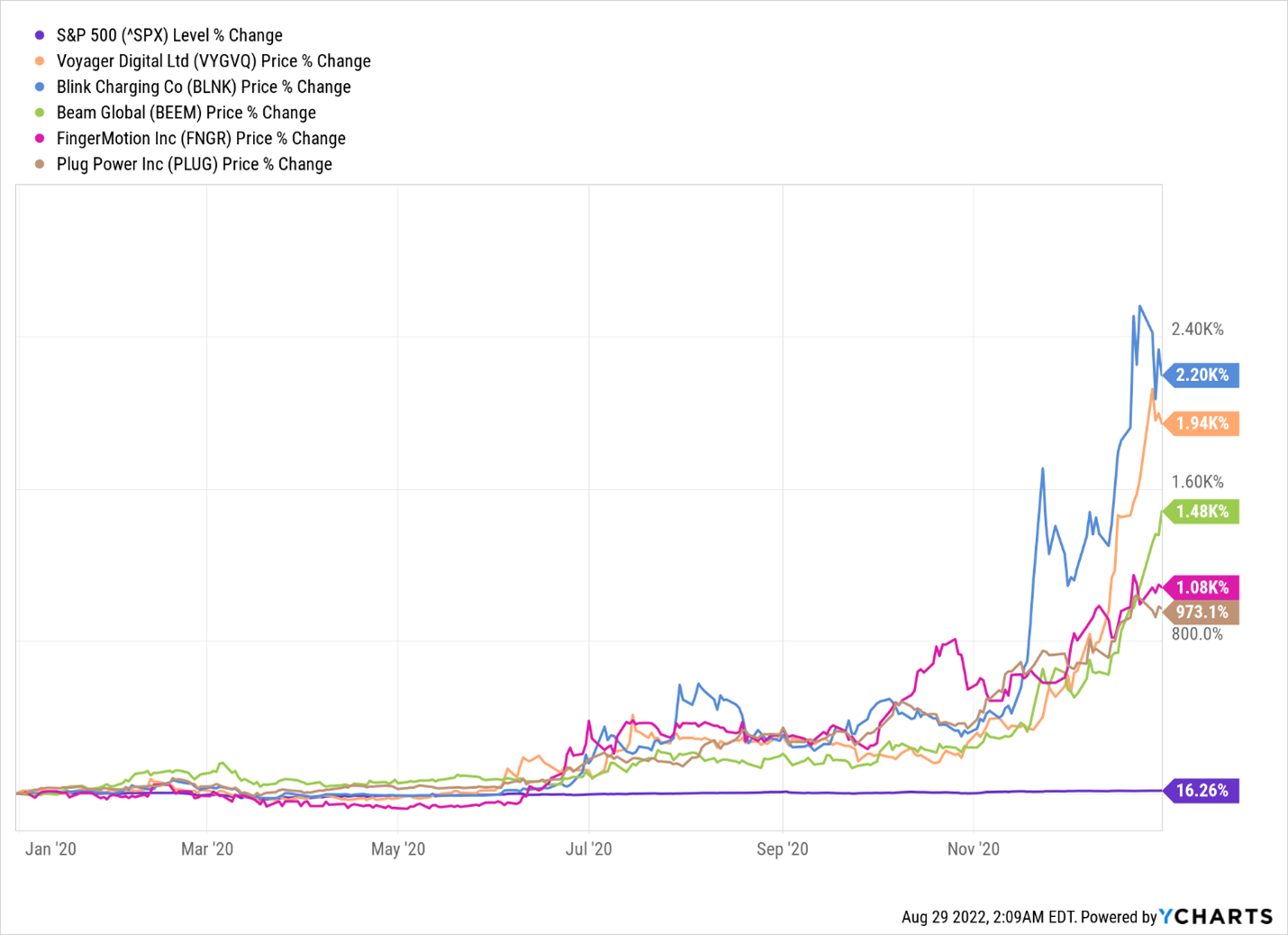

And that brings us to 2020 and the COVID-19 pandemic. Regardless of falling greater than 30% in the course of the bear-market low, the S&P climbed 16% on the yr.

In the meantime, Blink Charging (BLNK) made its buyers 2,190%. Voyager Digital (VYGVQ) returned 1,983%. Beam International (BEEM) soared 1,483%. FingerMotion (FNGR) added 1,084%, and Plug Energy (PLUG) climbed 973%.

That’s all in only one yr.

Even in 2022, with the worst inflation in 40 years and shares getting pummeled, you’re kidding your self if you happen to assume there weren’t localized bull markets.

Take power and transport shares, as an example.

Because of the Russia-Ukraine battle and extreme tightness within the oil market, the worth of oil stayed excessive in Q1 and Q2 of 2022. That despatched oil and fuel shares hovering and allowed some merchants to make some huge cash in oil shares.

This was additionally an enormous boon for sure transport shares that load exports of diesel and gasoline.

You possibly can have executed effectively with any of the massive oil names – Exxon (XOM), Chevron (CVX), or BP (BP). Within the first half of the yr, they gained between roughly 30% and 50%.

However a second in the past, we talked about 100%-plus returns.

Properly, by late summer season of 2022, ProShares Extremely Pure Gasoline (BOIL) had popped 305% on the yr. BP Prudhoe Bay Royalty Belief (BPT) was up 470%. And Scorpio Tankers (STNG) had risen 225%.

Once more, that is in lower than eight months – and through a broad bear market.

This isn’t an anomaly.

These individualized bull markets occur on a regular basis, and so they make their buyers life-changing returns.

So, the query turns into: how do you discover these mega winners?

Properly, that brings us to our brand-new quantitative system.

The Closing Phrase on Discovering Bull Markets

Tech shares, AI shares, semiconductor shares, and housing shares are all in a bull market.

There are bull markets actually in all places proper now.

However none are as explosive because the hidden bull market we’ve discovered to be the most explosive nook of the market. It’s a nook that, on any given day, week, month, or yr, accounts for greater than 30% of the market’s high performing shares.

There are actually lots of of shares on this particular hidden bull market that might soar 1,000% in lower than a yr.

In fact, there’s a catch: Investing on this specific hidden bull market could be exceptionally dangerous.

However my staff and I simply developed an AI-driven quantitative buying and selling mannequin to take away the guesswork and cut back the chance from investing on this notably explosive sector.

However know that this nook of the market is just for essentially the most critical merchants.

Excessive-risk, high-reward.

If that sounds such as you, then I urge you to attend our Grand Debut occasion on Tuesday, July 11, at 7 p.m. EST, after we will unveil this high-octane quantitative buying and selling system for the very first time.

On the date of publication, Luke Lango didn’t have (both straight or not directly) any positions within the securities talked about on this article.