At one cut-off date, tech shares took middle stage and have become an integral a part of each investor’s portfolio. Through the pandemic, they supplied distinctive options and loved huge rewards by way of investor curiosity, increased income, and rising market valuation.

Nevertheless, the previous yr was unkind to the tech trade. Inflation and considerations concerning the financial system’s future led to a serious drop in tech shares. Traders who held regular by way of the market retreat are having fun with sturdy returns at the moment. Choosing up tempo, tech shares as soon as once more have develop into a secure harbor. Now is an effective time to begin shopping for them to offer your portfolio a lift. They proceed to sail by way of the market, remaining engaging to all investor varieties whatever the scenario.

Holding tech shares for the long run can generate stable returns in your portfolio. Contemplating technological advances resembling synthetic intelligence, machine studying, and cloud computing, a savvy investor can see large progress potential for tech corporations. With the market lastly gaining traction, think about shopping for these three tech shares now.

Microsoft (MSFT)

Supply: Asif Islam / Shutterstock.com

If you must select just one sizzling tech inventory, it must be Microsoft (NASDAQ:MSFT). The 48-year-old tech dinosaur is a frontrunner within the trade and has constructed a legacy with its private pc market. For a lot of, it’s exhausting to think about working a pc with out Microsoft software program, but this is just one a part of the corporate. With its funding in AI, it has already develop into an AI trade chief. The corporate has invested over $13 billion in OpenAI and built-in it into its Bing platform. MSFT inventory is buying and selling at $334 at the moment and has generated over 200% outcomes up to now 5 years. The inventory is up 39% yr to this point. You would think about this explicit inventory one to purchase and maintain eternally.

Microsoft generates important income by way of the cloud computing platform, Azure. Within the current quarter, the corporate reported a income of $52.9 billion, and income from Clever Cloud stood at $22 billion. The software program large is already dominating in platform use, resembling Excel, Azure, and Phrase, by organizations throughout the globe. The mixing of OpenAI’s applied sciences means the efficiency and effectivity of its platforms are seemingly going to extend. A restoration within the private pc section can even drive progress sooner or later. For now, cloud computing would be the driving power for Microsoft.

A Microsoft inventory funding isn’t solely a option to put money into AI but additionally one of the simplest ways to benefit from the AI growth. Including it to your portfolio will convey stability, regular returns, and stable long-term progress. That mentioned, the corporate has a dividend yield of 0.81% and a quarterly dividend payout of $0.68.

Adobe (ADBE)

Supply: Koshiro Ok / Shutterstock.com

Adobe (NASDAQ:ADBE) is a widely known identify within the trade and trusted for a number of causes. The design app affords one of the best options to creators. Its Artistic Cloud helps run all the most important functions in a single system with ease. It has over 20 functions that enable customers to discover and broaden their creativity. The corporate hit all-time highs throughout the pandemic however has dropped since then. ADBE inventory is buying and selling at $489 at the moment, about 45% up yr to this point, and I consider this upward pattern is about to proceed this yr.

One of many largest causes to put money into Adobe is its motion into AI. The corporate not too long ago launched FireFly which is a generative AI software that allows the creation of movies, pictures, and digital fashions utilizing text-based prompts. It’s going to combine Firefly into its Artistic Cloud platform, making it simpler to create pictures. Whereas it’s too early to see generative progress from the AI instruments addition, chances are high excessive for higher numbers as soon as the corporate locks in customers.

Adobe is thought for maximizing undertaking creativity and producing its peak revenues from the subscription-based mannequin. Within the current quarter, the corporate grew income to $4.7 billion, a 9% year-over-year enhance, whereas the web earnings stood at $1.2 billion. Having reported progress on the highest and backside traces, Adobe is right here to take the enterprise increased.

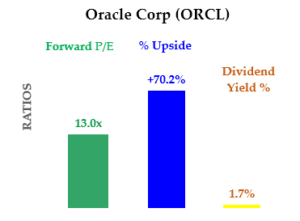

Oracle (ORCL)

Supply: Mark R. Hake, CFA

Oracle (NYSE:ORCL) has been round since 1979, when it created the earliest business relational database program to make use of Structured Question Language (SQL). Lengthy thought-about a distinct segment participant within the tech area, it’s a cloud supplier for a number of enterprise prospects and a prime contender amongst the tech shares. A majority of the corporate’s income comes from cloud providers. Oracle has additionally proven sturdy financials with a income progress of twenty-two% to $50 billion in addition to a 27% rise in internet earnings to $8.5 billion. The cloud section by itself generated $1.4 billion within the current quarter.

The corporate has seen about 50% progress within the cloud section which is more likely to proceed all year long. Regardless of excessive inflation, the corporate’s cloud enterprise continued to develop considerably. It’s at present specializing in the EU market which can assist broaden progress. It was already providing localized infrastructure for European prospects and now’s extending additional into the EU. ORCL inventory is buying and selling at a premium proper at present. It’s exchanging arms at $117, near an all-time excessive of $127. The corporate pays a dividend of $0.40 and has a dividend yield of 1.36%.

As an stablished enterprise with a predictable progress charge and regular earnings, Oracle is value shopping for proper now. Numbers show it’ll seemingly be a winner in the long run, one value proudly owning.

On the date of publication, Vandita Jadeja didn’t maintain (both straight or not directly) any positions within the securities talked about on this article. The opinions expressed on this article are these of the author, topic to the InvestorPlace.com Publishing Tips.